What is Asset Allocation?

Asset Allocation is Key

You don’t have to be an investment expert to be a successful retirement investor. In fact, the most important decision you need to get right is…asset allocation. Asset allocation is a key component to long-term success!

WHAT IS ASSET ALLOCATION?

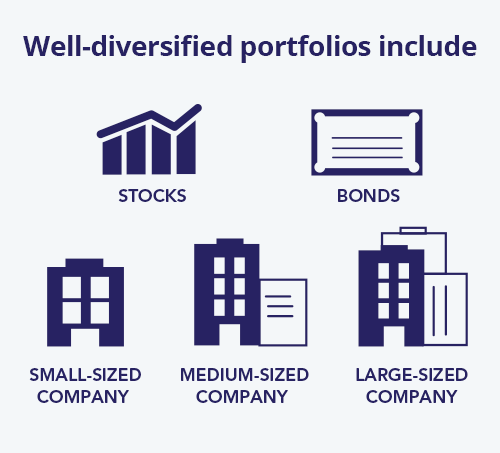

Asset allocation is an investment strategy that is designed to reduce risk by spreading an investor’s money among different asset classes such as stocks and bonds.

We believe in selecting an asset allocation that takes into consideration your age, your risk tolerance, and your goals. While this allocation will likely change as life happens (your goals change or you become older) we don’t recommend changing this asset allocation solely based on short term moves in the stock market.

When you’re investing to reach a long-term goal such as retirement, anticipate that there will be periods of poor investment performance due to the volatility that exists in the stock market. It’s important to not let your short-term emotions get in the way of your long-term investment decisions. You are better off sticking with a long-term investment strategy that fits your risk tolerance and time frame. Choosing the appropriate asset allocation that includes both stock and bond investments may provide you with the best opportunity to attain your retirement goal.

And keep in mind that your retirement account might just be one piece of the pie. If you have other sources of retirement income, such as savings accounts or IRAs, all of these need to be considered in determining your overall asset allocation. Consider consolidating your accounts where possible to make managing your assets easier.

This website does not provide investment, tax, financial or other advice. It is provided for informational and educational purposes only and is intended to be used as a guide.