Summer Market Update

Summer is finally here, but there is no vacation on Wall Street, as equity indices have continued their decline from the first quarter. The second quarter was much worse than the first, as investors have changed their focus from the path of Fed interest rate hikes to whether these hikes will spark a recession. From a Fed point of view, inflation is the enemy that must be contained, and they have changed their pace of interest rate hikes accordingly. The June CPI release for May showed that year over year headline inflation rose from April, which was a surprise for analysts. This pushed the Fed to raise their benchmark rate by 0.75%. This caused a sharp decline in domestic equities as investors quickly re priced the market to include a faster pace of rate hikes. However, this also caused recession fears to rise, as the higher interest rates get, the more restrictive monetary policy gets, which can slam the brakes on economic growth. As borrowing becomes more expensive, consumers take out less credit – everything from credit cards to mortgages – and therefore spend less. This directly affects the bottom lines of companies, as their revenues are then hit.

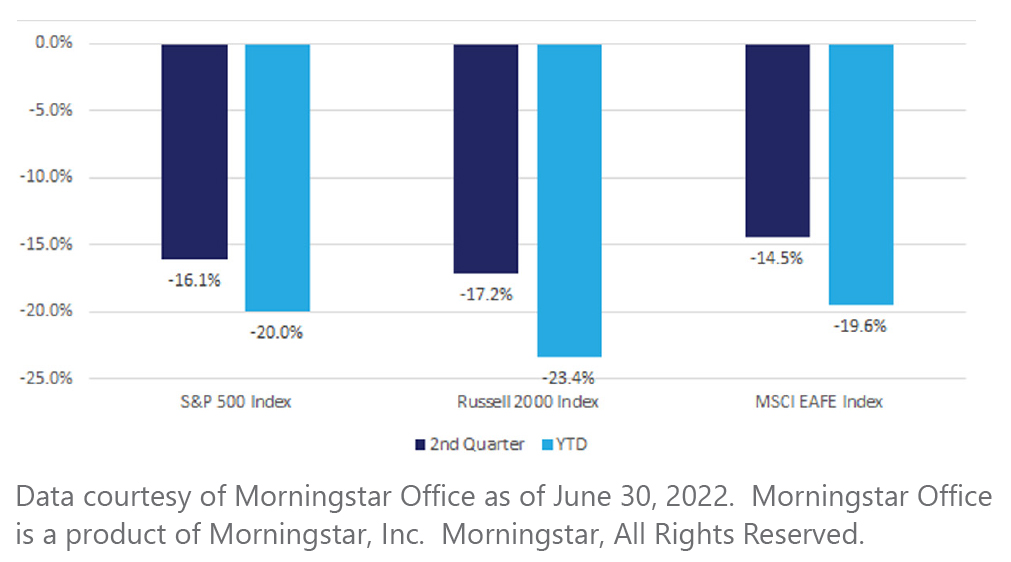

These developments helped stocks lose value in June, pushing the major domestic indices into bear market status (defined as a 20% drop from the most recent high). In the end, the S&P 500 Index notched its worst first half of a year since 1970.

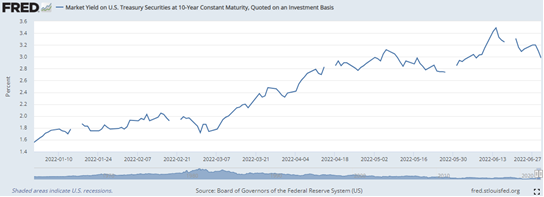

The bond market is in no better shape, with the Bloomberg U.S. Agg Bond Index now down over 10% for the year through June. Higher rate expectations have helped the Treasury yield curve rise sharply this year, depressing prices. The ten-year Treasury yield is now at a level not seen since late 2018. In fact, this yield has risen from 1.6% to start the year to close to 3% by the end of June.

So the big question is: Is a recession coming? This is almost impossible to answer since it involves forecasting the future, but we can look to current data for some hints. First, there’s inflation. Sustained inflation is a huge negative for the economy as it makes everything more expensive. We are currently in an inflationary environment that we haven’t seen in the last forty years, and pocketbooks are being pinched. Second, the Fed. They are raising rates in an attempt to rein in inflation, and with inflation at forty-year highs, they are aggressively pursuing this. This is rapidly causing borrowing costs to rise, which will further hamper spending. Third, we have consumer spending. This has remained remarkably strong over the past several months, but we are starting to see some possible pullback from consumers. Finally, employment. The reason why the Fed thinks it can aggressively pursue containing inflation is because the U.S. employment market is so strong. The unemployment rate is historically low and there are many more jobs available than there are workers. This is a positive for the economy, as work is plentiful for those who want it.

With all of this said, many analysts and fund managers have been raising the recessionary flag, with many forecasting entering one in 2023. This doesn’t mean that it will happen, just that current data seems to be pointing in that direction.

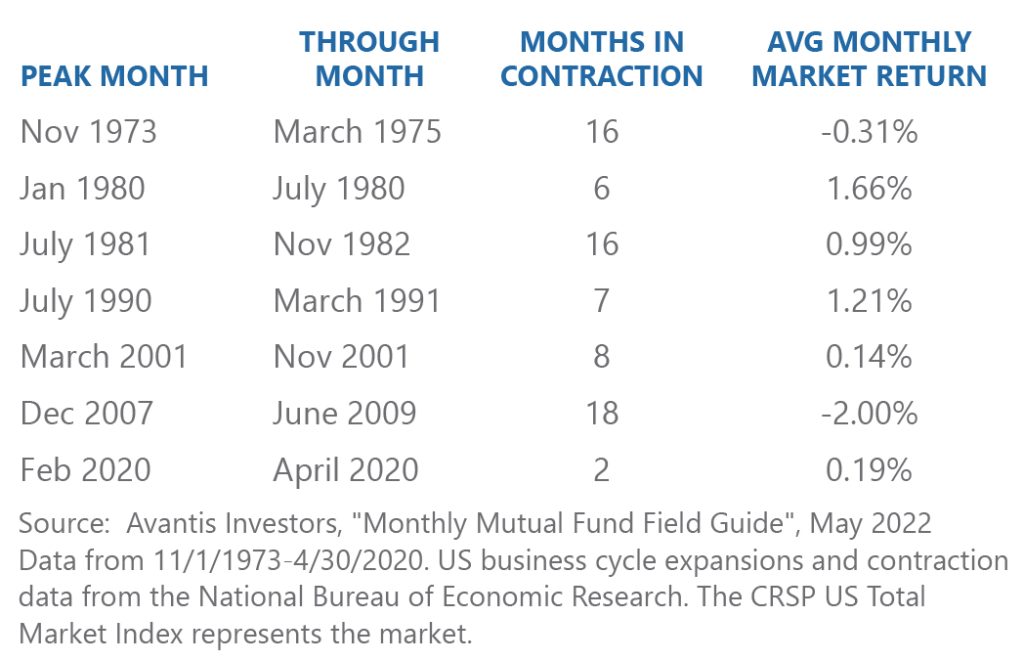

When thinking of recessions and equities, one may assume that they are correlated. Weakness in the economy should mean weakness in stocks, right? Not exactly. Avantis, an ETF and mutual fund company associated with American Century, recently published a study that found that the stock market (measured by the CRSP U.S. Total Stock Market Index) only fell during two of the past seven recessions. The reason for this is that the stock market is forward looking, so even though the economy may be contracting, the stock market may be advancing during the same period since investors are looking past the current recession. We reviewed performance of the Russell 3000 Index (very similar to the CRSP U.S. Total Stock Market Index) over each time period shown and every time, equities ended the recessionary period on an uptrend.

We know that it is a stressful time to be invested, and it seems that there is nothing but negative news circulating everywhere. However, it’s important that you realize the reason why you are investing in the first place. Maybe it’s for retirement, a future purchase, or even for future generations. If your goal hasn’t changed, should your allocation? Most likely not, which is why we recommend staying the course.

Have questions about what this means for you or your plan? Contact our team.

All investment advisory services and fiduciary services are provided through Conrad Siegel Investment Advisors, Inc. (“CSIA”), a fee-for-service investment adviser registered with the U.S. Securities and Exchange Commission with its principal place of business in the Commonwealth of Pennsylvania. CSIA operates in a fiduciary capacity for its clients. Investing in securities involves the potential for gains and the risk of loss and past performance may not be indicative of future results. No award, ranking or designation referenced herein is to be interpreted as an endorsement, testimonial, recommendation or referral with respect to any Conrad Siegel entity, its representative or its investment advisory services. No fee was paid for CSIA’s inclusion or consideration. The criteria for the rankings, awards and/or designations referenced above can be found at conradsiegel.com/csia-disclosure. CSIA and its representatives are in compliance with the current notice filing registration requirements imposed upon registered investment advisors by those states in which CSIA maintains clients. CSIA may only transact business in those states in which it is noticed filed, or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by CSIA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about CSIA, please refer to the Firm’s Form ADV disclosure documents, the current versions of which are available on the SEC’s Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) and may also be made available upon request. This material is as of the date indicated, is not complete, and is subject to change. Additional information is available upon request. No representation is made with respect to the accuracy, completeness or timeliness of information and CSIA assumes no obligation to update or revise such information. Certain information has been provided by and/or is based on third party sources and, although believed to be reliable, has not been independently verified and CSIA is not responsible for third-party errors. This information is not a recommendation, or an offer to sell, or a solicitation of any offer to buy, an interest in any security advised by CSIA.