Retirement Plan Investment Menu | Taking a look into the Industry Average

We are often asked how a plan’s investment menu compares to the industry average. Plan Sponsors want to know how their menu looks compared to peers. There are two primary reasons for this. First, a retirement plan is used as a retention tool and sponsors want to make sure they are competitive with their offering. Second, sponsors have a fiduciary responsibility and want to be in-line with industry standards.

In this article, we have highlighted a few aspects of the menu that we believe are not only interesting but important considerations for a fiduciary. We’ve focused on the size of the investment lineup and what types of funds are used. It’s important to remember that there is not a one-size-fits-all investment lineup. As a fiduciary you are responsible for offering a lineup that is appropriate for your participants.

- Menu size

- Index vs. active (non-index)

- ESG investments

- Alternative investments

- Asset categories and participant utilization

Industry Average – Menu Size

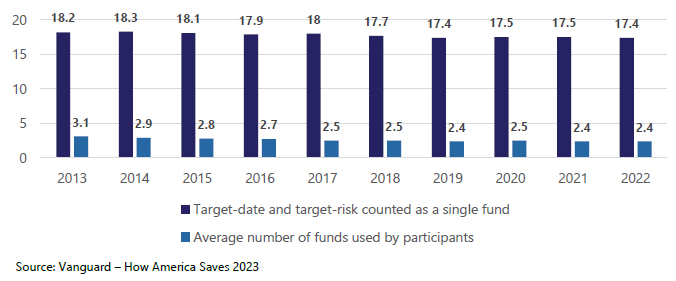

The number of funds used by participants in retirement plans has declined over the past decade. This is most likely attributed to the creation of target date and target risk funds. If counting target date and target risk as a single offering, the median investment menu contains 16 options.

Conrad Siegel’s thought on Menu Size

We believe an investment menu should consist of approximately 12 funds, in addition to a suite of target-risk or target-date funds. A larger plan, when looking at number of participants or asset size, might choose to offer more funds than average and a smaller plan may find it prudent to offer fewer. It’s important to select the right number for your organization to allow participants to adequately diversify their portfolio but at the same time not offer too many options as it could cause confusion when participants go to choose their investment mix.

Industry Average – Index vs. Active

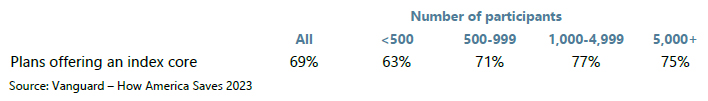

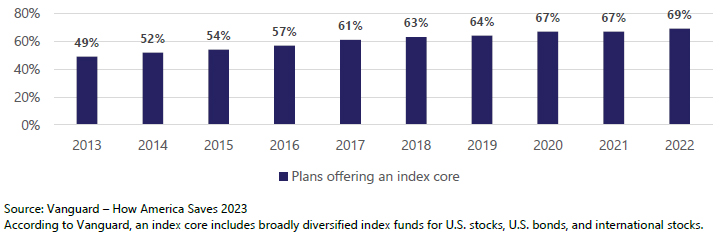

It’s not uncommon in retirement plans to see the lineup consist of both index and active funds. However, the core of the menu continues to trend in the direction that consists of index funds. According to Vanguard’s How America Saves 2023 report, 69% of their plans offered a core index approach and nearly 7 out of 10 participants were offered an index core.

As seen below, this trend has continued to increase over the last decade.

Conrad Siegel’s thought on index vs. active:

Actively managed mutual funds attempt to beat their benchmarks. However, very few mutual fund managers actually do so. This is primarily because market timing and picking the right securities is difficult to do on a consistent basis. Therefore, we believe the core of an investment portfolio should include index mutual funds, which aligns with the industry standard.

We view a core lineup of index funds consists of a total bond fund, a large cap domestic equity fund, an extended market equity fund, which gets you exposure to the mid and small cap domestic market, an international equity fund, and an emerging markets equity fund. Depending on how many funds you want to offer, you could condense that core to just three funds, a total bond, a total domestic equity and a total international equity fund.

Industry Average – ESG Investments

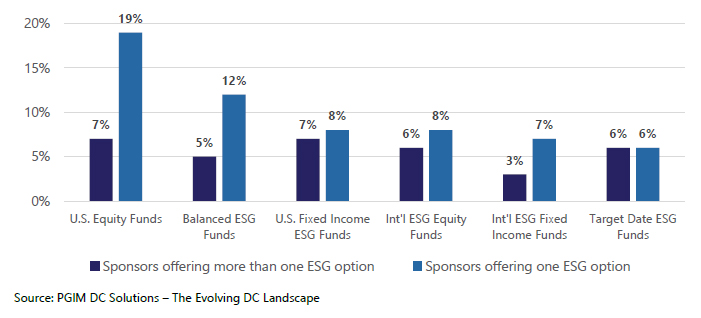

As we have noted in previous articles, ESG funds have been a controversial topic due to ever-changing policies from the current and previous administrations. As a result, sponsors have been hesitant about offering ESG funds to their employees. According to data compiled by PGIM DC Solutions, only 1 in 4 plan sponsors report offering one ESG option. Even fewer are offering multiple ESG options.

Conrad Siegel’s thought on ESG:

We don’t believe a plan sponsor should set out to add a good ESG fund, we would rather add a good fund that happens to be ESG. An ESG fund should meet IPS criteria, perform in line with benchmark and peers, and offer potential value over a non-ESG counterpart.

If an ESG fund is added to the lineup, it should be in addition to a non-ESG fund in that same asset class. Participants should not be forced into investing in ESG to get exposure to a certain asset class. The ESG or not decision should be made by the participant.

There should be documentation on why you are adding. An example would be that there are participant requests, and you believe participation or savings rates would increase with the offering of ESG.

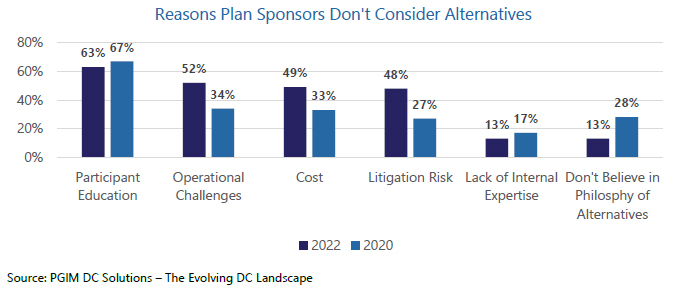

Industry Average—Alternative Investments

Alternative investments have very low usage in retirement plans. Alternative investments include things such as private equity, hedge funds, real estate, commodities, and energy. PGIM reports that plan sponsors are hesitant to offer alternatives due to the lack of participation, operational challenges, and associated costs (notably, litigation risk and cost).

Conrad Siegel’s thought on Alternatives:

Alternative investments typically carry higher expenses and additional risk due to their undiversified nature. These investments require additional education and are often seen in litigations within retirement plans. Due to these reasons, we continue to believe alternative investments are not appropriate for the average participant. If you have highly sophisticated investors that are looking for more, a consideration would be to offer a self-directed brokerage option.

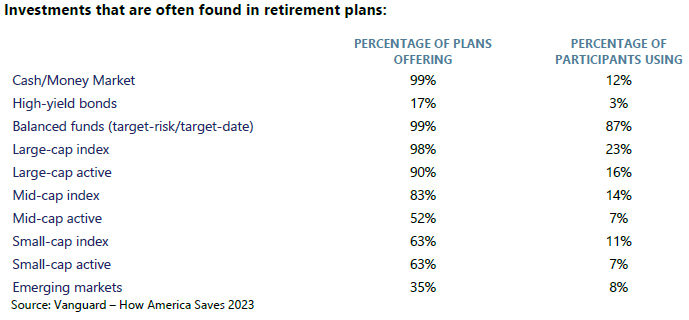

Industry Average—Asset categories and participant utilization:

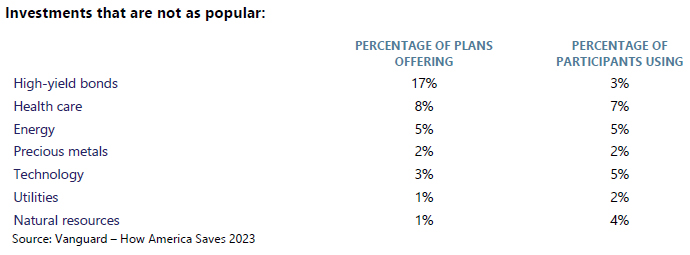

So, what are the most popular asset classes that plan sponsors offered to participants? To help answer this question, we have outlined data below from Vanguard’s How America Saves 2023 report.

Conrad Siegel’s thoughts on asset categories and participant utilization:

Since it’s virtually impossible to predict ahead of time how any given asset class will perform, it is important to have a menu that is broadly diversified in a variety of asset classes and styles. When it comes to a diversified menu, that doesn’t mean that you need to offer a fund in each style box (or category). You may ask why? Most funds span several style boxes (large, mid, small) despite being categorized as just one. If participants are looking for broad diversification and market like exposure, offering a total market fund or a large blend, mid blend, and small blend fund may be sufficient. We believe sponsors need to consider if participants really understand the style boxes and how to combine various funds to get the diversification they are looking for. In addition, much like the alternative investments covered in the previous section, the sector funds or funds listed under the “not as popular” table often carry higher expenses and are more volatile. Most retirement plan participants do not have a good understanding of how they are structured and therefore, in most cases, we do not believe they should be part of a retirement plan menu.

Your organization’s retirement plan is complex, full of ever-changing details, regulations, and oversight. We have built our reputation on understanding those complexities and helping plan sponsors build strong retirement plans. Reach out to our friendly team – we are experts at taking retirement plans’ most complex elements and simplifying them. We will tell you what you need to know, why, and what you should do.

Sources:

Vanguard’s How America Saves 2023

https://www.pgim.com/press-release/most-plan-sponsors-taking-steps-solve-retirement-income-challenge-pgim-survey

All investment advisory services and fiduciary services are provided through Conrad Siegel Investment Advisors, Inc. (“CSIA”), a fee-for-service investment adviser registered with the U.S. Securities and Exchange Commission with its principal place of business in the Commonwealth of Pennsylvania. Registration of an Investment Advisor does not imply any level of skill or training. CSIA operates in a fiduciary capacity for its clients. Investing in securities involves the potential for gains and the risk of loss and past performance may not be indicative of future results. Any testimonials do not refer, directly or indirectly, to CSIA or its investment advice, analysis or other advisory services. CSIA and its representatives are in compliance with the current notice filing registration requirements imposed upon registered investment advisors by those states in which CSIA maintains clients. CSIA may only transact business in those states in which it is noticed filed, or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by CSIA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about CSIA, please refer to the Firm’s Form ADV disclosure documents, the current versions of which are available on the SEC’s Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) and may also be made available upon request.