Reminder Regarding your Plan’s PBGC Premium

Background

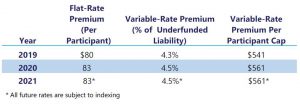

The Pension Benefit Guaranty Corporation (PBGC) premium increases to both the single-employer Flat-Rate and Variable-Rate premiums continue in 2019. PBGC premium rates are scheduled as follows:

How will this affect your plan?

- Your PBGC premium payment may increase in 2020 and future years due to these changes and several other contributing factors:

-

- The existing low interest rate environment

-

- Lower required pension contributions due to current pension relief, which may increase the unfunded level of the plan

What can Plan Sponsors do to lower PBGC Premiums?

- Talk to your Consulting Actuary today about the following options:

- Strategies to fund the plan. This can include accelerating contribution payments, increasing contribution amounts or borrowing to fund the plan .

- Strategies to reduce the participant count. Lump Sum Windows may be an option, depending on the interest rate environment.

- Long-term planning for the plan, such as asset derisking or plan termination planning.

Questions on how this affects your plan?

Questions on how this affects your plan?

Contact our experts directly!

Contact Abby

All investment advisory services are provided through Conrad Siegel Investment Advisors, Inc. (“CSIA”), a fee-only investment adviser registered with the U.S. Securities and Exchange Commission. This article contains general information about recent US tax reform and should not be relied upon as the basis for any investment, tax or legal decision. Please consult with your financial or accounting professional.