Update – Market Volatility and the Coronavirus (3.23.2020)

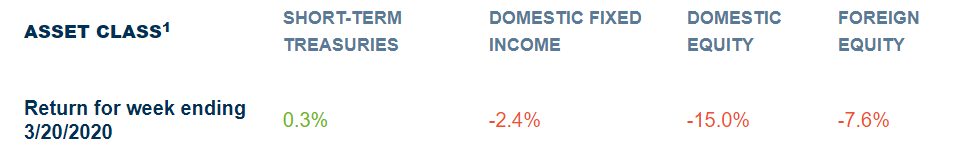

The spread of the novel coronavirus, specifically referred to as COVID-19, has evolved into a global pandemic. The center of the outbreak has shifted from China to Europe with the continent having a higher number of cases and Italy having the most deaths of any country. The number of confirmed cases in the US, now over 35,000, has increased dramatically as testing capabilities have expanded. There have also been developments from a governmental and economic standpoint over the past week. The Federal Reserve continues to take actions to support the economy and financial markets. Also, Congress continues to debate and pass legislation aimed at supporting citizens and businesses impacted by the COVID-19 outbreak. The pending legislation is the largest of those considered so far. From an economic point of view, there is still much uncertainty to what the extent of the damage will be. This past week saw many countries in Europe and many individual states in the U.S. issue orders defining life-essential businesses that can stay open while others must close their brick and mortar stores. These same orders are also limiting the movement of citizens to help slow the spread of the virus. The result has been a decrease in spending and an increase in layoffs, with both being projected to increase further. The markets reacted negatively across the board with only the safest of asset classes, short-term US Treasuries, posting positive returns for the week.

When it comes to viewing your own investments through this event, we encourage you to consider the risks present in the market, but avoid making short-term decisions with long-term money. While the COVID-19 virus will undoubtedly have an economic impact, the movement of the markets currently appears to be driven by daily sentiment and panic. We would discourage the ideas of exiting the market completely or trying to time the bottom of the market and increase equity exposure. Instead, consider your time horizon, the risk in the market (short-term and long-term), and make the appropriate adjustments to your investments.

1 Short-Term Treasuries = BBgBarc US 1-3 Y Govt Float Adj TR USD, Domestic Fixed Income = BBgBarc US Agg Float Adj TR USD, Domestic Equity = S&P 500 TR USD, Foreign Equity = MSCI ACWI Ex USA NR USD. If available, performance information is from Morningstar, Inc. © Morningstar, Inc. All Rights Reserved. The information, data, analyses and opinion contained herein (1) include the confidential and proprietary information of Morningstar, Inc., (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, Inc., (4) are provided solely for informational purposes and (5) are not warranted to be correct, complete or accurate. Morningstar, Inc., shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Index data is provided by Morningstar, Inc. for fund benchmarking purposes only. The index data is copyrighted by the index provider.