Finally, the Pivot

It was something that investors were waiting over a year for – an announcement from the Federal Reserve (“Fed”) that they no longer expected to raise their benchmark Fed Funds Rate. This announcement, which happened on December 13th, also included some bonus information for investors in the form of more expected rate cuts in 2024 than previously thought.

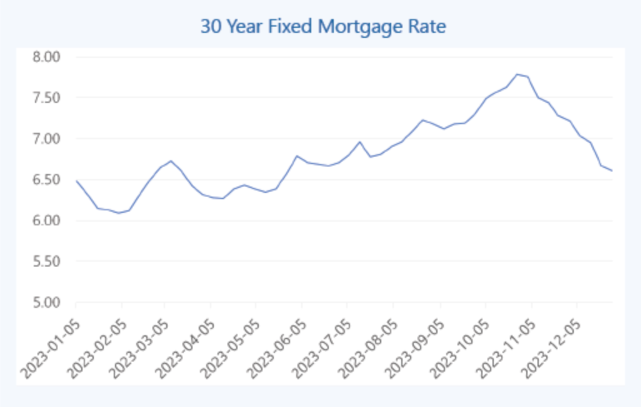

This is a major development, as high borrowing costs have hurt both consumers and investors. For consumers, the issue has been mortgage rates. The thirty-year fixed mortgage rate peaked on October 26th at 7.79%, which was the highest this rate has been since 20011.

For investors, high interest rates affected both stocks and bonds. For stocks, high rates mean higher borrowing costs for companies, hurting bottom lines. For bonds, prices move in the opposite direction of interest rates, which meant that bond investments were negative for the year through October. However, bonds quickly rebounded in the final months of 2023 as interest rates sank.

For many equity investors, however, another story greatly affected returns – AI. For the first three quarters of the year, AI helped to keep the stock market afloat, with huge gains seen in relatively few stocks powering well-known indices like the S&P 500 Index.

But the major story of the year was the Fed and what they were planning to do regarding their benchmark Fed Funds Rate. The market continuously underestimated just how high the Fed was willing to go, which caused several short-term bull and bear markets during the year. It took until December for the Fed to finally remove any mention of possible hikes in their meeting minutes. While investors cheered this, there is still a wide gulf between market and Fed interest rate expectations for 2024. The market expects the Fed Funds Rate to finish 2024 at 3.62% while the Fed expects it to be 4.60%2. This is a huge difference and one that will have to consolidate over time. How fast it consolidates will likely determine just how volatile risk assets are going to be in 2024.

1Source: https://www.freddiemac.com/pmms

2Source: JP Morgan Guide to the Markets, quarterly version. As of December 31, 2023.