Fiduciaries Find Fees Fascinating

While this title may be a stretch, monitoring and understanding fees is a crucial part of a fiduciary’s responsibilities. Monitoring the level of fees your Plan is paying is an important first step, but there are other important questions that also need to be answered. How is the Plan paying fees? How is the fee formula structured? The next few paragraphs will look to provide background on these questions and how they relate to investment fees.

There are three methods in which fees are received by providers: directly, indirectly, or a combination of the two. When paying fees indirectly, the cost of the investment advisor and/or recordkeeper is included in the fund expenses, often called revenue sharing or a 12b-1 fee. While this structure is most common for defined contribution plans, it can be an extra source of revenue for some advisors of defined benefit plans as well. It is important to note that just because you are not getting an invoice for the provider’s services, this fee still deserves your attention. When using revenue sharing, different investments often generate different levels of revenue sharing. As long as the total revenue sharing exceeds the fee, the invoice can be processed and any excess may become a refund or credit. However, different levels of revenue sharing among investments results in different fee levels on a participant level, which is a fiduciary concern. We highly recommend our clients explore fee leveling within their Plans.

Paying fees directly is the most common  structure within defined benefit plans. There are several ways a direct fee schedule can be structured. The fee structure is usually described as a percentage of Plan assets or Assets Under Management (AUM). The fee formula can be the same for all assets in the account (ex. 0.30% of AUM) or a tiered fee schedule (ex. 0.30% of the first $5 million and 0.15% on all additional assets). Supporters of a tiered fee schedule note that there are efficiencies when working with larger accounts and reducing the fees on additional dollars passes some of these savings back to the client. If your Plan has grown a lot since the current fee schedule was set or you anticipate it increasing in the future, the tiered fee schedule can make a significant impact in the total fees paid.

structure within defined benefit plans. There are several ways a direct fee schedule can be structured. The fee structure is usually described as a percentage of Plan assets or Assets Under Management (AUM). The fee formula can be the same for all assets in the account (ex. 0.30% of AUM) or a tiered fee schedule (ex. 0.30% of the first $5 million and 0.15% on all additional assets). Supporters of a tiered fee schedule note that there are efficiencies when working with larger accounts and reducing the fees on additional dollars passes some of these savings back to the client. If your Plan has grown a lot since the current fee schedule was set or you anticipate it increasing in the future, the tiered fee schedule can make a significant impact in the total fees paid.

Another direct fee structure we will examine is when a provider charges a flat fee for service, possibly indexed with inflation. This fee structure hasn’t been as common historically; it is beginning to be used by some providers. While there has been concern by some that the fee structure does not align the goals of the Plan and advisor as well as the percent of assets fee structure, we disagree. The AUM approach incentivizes the investment advisor to increase Plan assets; more assets equals more fees. However, what incentive does it give to match the risk tolerance of the Plan? What if the goal is not to increase assets, but to reduce the volatility of the funding requirement? The flat fee structure may not provide extra incentive to increase assets, but encourages the advisor to meet all of the client’s goals and provide a high level of service to continue the relationship. The advisor will receive the same payment for the same level of work and the Plan’s relative fee will decrease as assets increase. If your Plan uses or prefers a bundled approach for its pension services, the flat fee structure may be an important step to avoid any possible conflict of interest by your provider. The possible conflict can arise when an assumption change or funding strategy developed by the actuary results in increased contributions and, therefore, increased investment advisory fees.

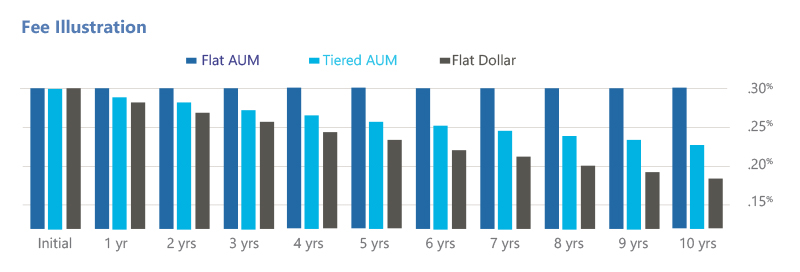

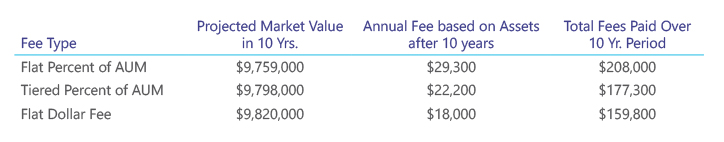

To illustrate how the structure of fees impact total cost over time, consider the following fee schedules:

- 0.30% of Assets Under Management

- 0.30% of first $5 million, 0.15% on all additional assets

- A flat fee of $15,000 per year increased with inflation in future years

For a $5 million dollar plan, the initial fee is identical in all three cases. But what happens as the Plan grows? The chart below shows how the fee changes as a percent of plan assets over the next 10 years. It is also worth noting the impact the different fee schedules on the projected market value and total fees paid over a 10-year period.

Conrad Siegel believes documenting and understanding all fees associated with a retirement account is an important element of a fiduciary review. It helps to satisfy fiduciary responsibility and identify any fee structures that may need to be reviewed to better position the Plan for long-term success. We recommend partnering with a provider that will serve as a co-fiduciary on your retirement plan and conducts a transparent fiduciary review on an annual basis.

All investment advisory services and fiduciary services are provided through Conrad Siegel Investment Advisors, Inc. (“CSIA”), a fee for-service investment adviser registered with the U.S. Securities and Exchange Commission with its principal place of business in the Commonwealth of Pennsylvania. Registration of an Investment Advisor does not imply any level of skill or training. CSIA operates in a fiduciary capacity for its clients. Investing in securities involves the potential for gains and the risk of loss and past performance may not be indicative of future results. Any testimonials do not refer, directly or indirectly, to CSIA or its investment advice, analysis or other advisory services. CSIA and its representatives are in compliance with the current notice filing registration requirements imposed upon registered investment advisors by those states in which CSIA maintains clients. CSIA may only transact business in those states in which it is noticed filed, or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by CSIA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about CSIA, please refer to the Firm’s Form ADV disclosure documents, the current versions of which are available on the SEC’s Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) and may also be made available upon request.