The Fed and You (Part 1 – Inflation)

The Federal Reserve (the “Fed”) plays a vital role in both the U.S. economy and in economies around the world, but you rarely get to see the members, and they only meet eight times a year. Who are they, what exactly do they do, and how do their decisions affect your money?

The Federal Reserve is the central bank of the United States. It provides oversight to the largest banks in the country and also acts as a lender/depositor for all domestic banks. The Fed is made up of the seven member Board of Governors, who oversee the Federal Reserve System. There are also a regional set of Federal Reserve banks, who each provide assistance and services to United States banks. The Federal Reserve System has five general functions, with these being: Conducting the nation’s monetary policy; promoting the stability of the financial system; promoting the safety and soundness of individual financial institutions; fostering payment and settlement of individual financial institutions; and promoting consumer protection and community development. However, most people only know the Fed as the entity that monitors and maintains monetary policy here in the United States. This policy is reviewed and set by the FOMC, or the Federal Open Markets Committee.

This Committee is made up of the seven members of the Board of Governors and five presidents from the pool of 12 regional Federal Reserve banks. Because the United States is the biggest economy in the world, their decisions also affect other countries as well. While the level of inflation is often the main topic associated with the Fed, many people don’t know that inflation isn’t the only mandate the Fed has. Their two mandates are to maintain or to achieve maximum employment and to monitor inflation. Its ultimate goal is to maintain financial stability.

We will focus on inflation in this article, with the intention of covering “maximum employment” in our fall inSights piece.

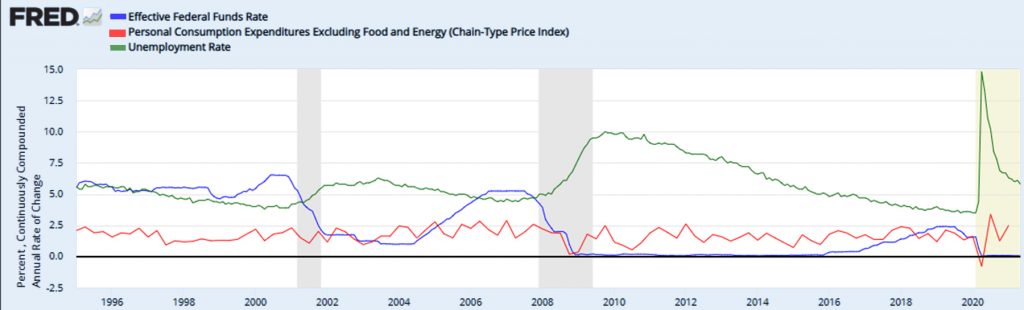

For years, they have targeted 2% inflation, as measured by the Personal Consumption Expenditures Index (“PCE”). This index is similar to the Consumer Price Index (“CPI”), but the characteristics and weightings are a bit different. When the PCE would rise above 2%, the Fed would start thinking about raising rates, and vice versa. In the summer of 2020, the Fed changed this policy, saying that they would allow for inflation to “average” 2%. Their thinking is that they will allow inflation to run hot for a time if they believe it will move the economy meaningfully closer to full employment.

What does it mean when the Fed has “raised rates” (or lowered them)? It means that the FOMC has changed the Federal Funds Rate. This is the interest rate that banks charge other banks for overnight loans within the Federal Reserve System (Policy Tools, 2020). Banks use these loans to raise their cash reserve levels to meet overnight holding rules. Banks must hold enough in reserves overnight to satisfy these rules.

The Prime Rate is a good example of an interest rate that is affected by the Federal Funds Rate. The Prime Rate is the interest rate that banks charge other banks, outside of the Federal Reserve System, for overnight loans. You have probably heard of the Prime Rate, as it’s the rate quoted in many loan arrangements.

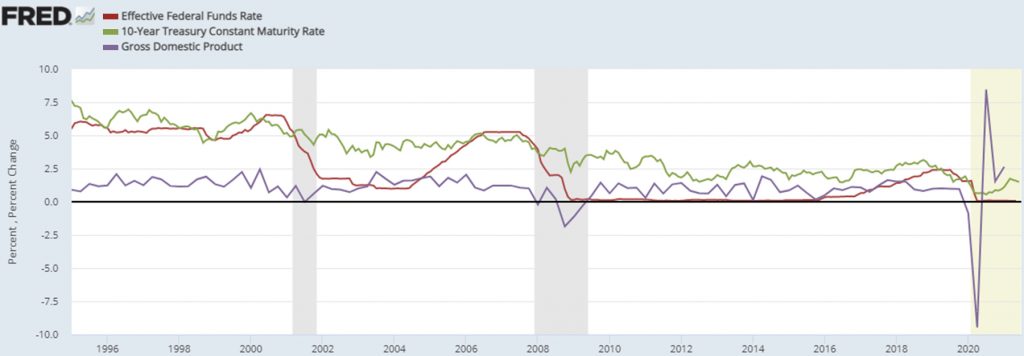

The effects don’t stop there. Because the Federal Funds Rate is an extremely short-term interest rate, it typically has the largest impact on other short-term interest rates. For instance, extremely short-term U.S. Treasury bonds are very sensitive to any change in this rate. The same can be said for money markets. The Federal Funds Rate has been extremely low for nine of the last twelve years. This is a major reason why money market returns have been so low.

The impact this rate has on short-term market rates is well established. However, it doesn’t have as much of an effect on longer-term rates. An example is the ten-year U.S. Treasury yield. Longer-term rates tend to be much more effected by inflation, growth expectations, and the supply/demand dynamic in the bond market.

Personal loan rates, car loan rates, and checking and savings deposit rates are all indirectly affected by changes in the Federal Funds Rate. So while you probably see low savings account rates as bad, if you are out looking for a loan, you’ll most likely view low rates as a positive.

As you may have gleaned from the above, the overall effect of raising the Federal Funds Rate is to remove excess cash from the economy, hopefully slowing it down, causing inflation to drop. Lowering the rate should have the opposite effect. This is only one tool that the Fed has in its arsenal though. Other strategies the Fed can try would be the following:

Asset purchases/sales: the Bank goes out into the market to purchase and or sell securities to manage interest rates and cash in the economy. To boost cash levels, they would buy bonds on the open market. This would cause interest rates to fall and provide the economy, via financial institutions where the Federal Reserve would make purchases, extra cash. If they sell securities, the opposite effect should ensue.

Change the reserve requirement of member banks. The Fed can set this level based on economic conditions. If the economy is running too hot, they would raise this level. This would limit how much banks can lend out by causing them to hold more cash. Lowering this level would allow banks to lend out more cash, hopefully stimulating the economy.

While working mostly behind the scenes, the Fed has still managed to step into the limelight, especially since the Great Recession. Actions that helped them gain more attention include its ultra-low interest rate policy and its accommodative monetary policy that went to levels and portions of the market that were unprecedented in the past. Equity and fixed income markets are now on the edge of their seats during each Fed news conference, looking for any clues as to where the Fed may be headed with their current policies. This includes the now famous “dot plot.” While this graph garners a lot of attention and markets can react to changes from the last version, it is important to remember that the dot plot itself does not result in any direct changes or actions.

It is merely a poll of the FOMC members on where they think the median Federal Funds Rate will be in their personal projections looking into the future. Still, it provides a vital look into members’ thinking towards the future direction of the Federal Funds Rate, and has become a powerful and important tool that can influence markets just by setting expectations. Attempting to influence the market by just setting expectations is sometimes referred to as forward guidance and is another policy tool. Happy Fed watching!

Sources: Federalreserve.gov/monetarypolicy/fomc.htm

https://fred.stlouisfed.org/