Collective Investment Trusts, also known as CITs, have continued to make headlines in the retirement plan industry. In the evolving retirement plan landscape, CITs are gaining traction as an attractive investment vehicle for participants and plan sponsors. Once a niche offering, CITs are becoming increasingly popular among plan sponsors and participants due to their cost structure. In this article we will take a look at CITs, what they are, the advantages, disadvantages, and of course, what plan sponsors need to know.

What are CITs?

Collective Investment Trusts are pooled investment funds established by banks or trust companies and are designed for institutional investors (such as retirement plans), to pool their assets and invest in a diversified portfolio.

The Key Advantage Driving Popularity

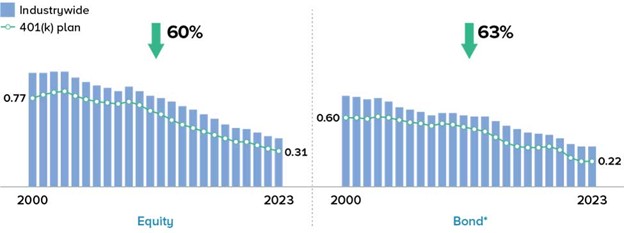

The most compelling reason for the rise in CIT popularity is their cost structure. CITs typically have lower expense ratios compared to mutual funds. This is primarily because CITs do not incur the same level of regulatory compliance costs and marketing expenses. The retirement industry has continued to focus on fee compression, especially in the fund expense segment. According to ICI, an association representing regulated funds, released research showing a steady decline of mutual fund fees resulting in a 60% drop since 2000.

Growing Adoption in Retirement Plans

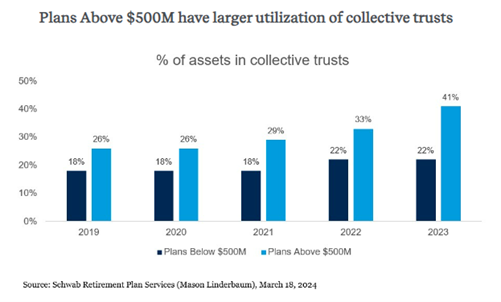

According to industry reports, CITs have been growing at a faster pace compared to mutual funds in retirement plans. CIT asset growth has expanded over the past few years, now accounting for over 40% of total retirement plan assets. Most of the growth has been in mega-sized retirement plans.

So, what do plan sponsors need to be aware of when thinking about CITs for their retirement plan menu? Yes, lower fees are always favorable for plan participants. However, there are disadvantages of CITs that sponsors need to take into consideration when vetting these options. Understanding these potential drawbacks can help sponsors in making more informed investment decisions.

Potential Drawbacks

- Limited Accessibility: Many CITs are only available for large institutional investors. Smaller plans may not qualify for many of the asset minimums required to access CIT options.

- Regulatory Oversight Differences: CITs are not regulated by the SEC, like mutual funds. Instead, they are regulated by banking authorities or the Office of the Comptroller of the Currency (OCC). This means they are subject to different regulatory standards, which might not be as comprehensive as those applied to mutual funds. While CITs must comply with the Employee Retirement Income Security Act (ERISA), some investors may perceive this as less rigorous compared to the oversight of mutual funds from the SEC.

- Transparency and Disclosure Issues: Although CITs are required to provide periodic reports to plan sponsors, the level of transparency and disclosure may not be as extensive as that for mutual funds. CITs are not publicly traded so they aren’t required to publicly disclose reports like prospectuses or even post a daily NAV, that mutual funds do. This can make it more challenging for plan sponsors and participants to fully access the performance, fees, and underlying holdings of a CIT.

- Liquidity Constraints: CITs can have different liquidity characteristics compared to mutual funds. Some CITs may impose restrictions on withdrawals. This lack of liquidity can be a concern, particularly in times of market stress, if a plan is moving recordkeepers, or if a plan needs to remove a CIT option due to performance concerns.

- Potential for Less Familiarity: Many plan sponsors and participants are more familiar with mutual funds and their associated regulatory frameworks. CITs, being less well-known, may require additional education and understanding, which can be a barrier to adoption for some retirement plans.

- Additional Paperwork: Since CITs are offered through trust companies and banks, additional paperwork is typically required between the plan sponsor and the CIT issuer.

For plan sponsors and participants, it’s crucial to weigh these disadvantages against the advantages and conduct thorough due diligence when evaluating CITs. By understanding both the benefits and limitations, retirement plan sponsors can make more informed decisions that align with their investment goals and fiduciary responsibilities.

Your organization’s retirement plan is complex, full of ever-changing details, regulations, and oversight. We have built our reputation on understanding those complexities and helping plan sponsors build strong retirement plans. If you have questions about your retirement plan, reach out to our team!

Conversation Clip | Mutual funds, ETFs, CITs – What are the differences?