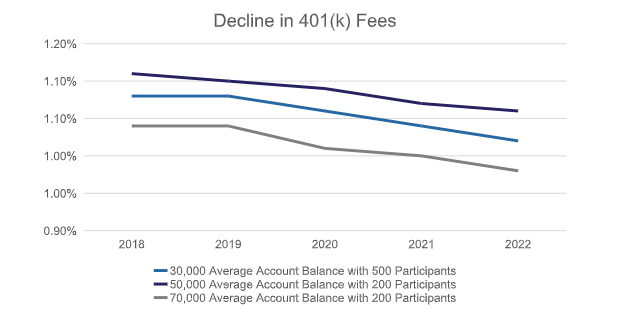

401(k) Plan Costs Continue to Decline

Great news for plan participants and plan sponsors! According to the latest annual edition of the “401k Averages Book”, total costs for 401(k) plans declined an average of 3 basis points in 2022. This has been a trend in the retirement plan industry the last few years. Fee awareness has been on the rise for participant directed retirement plans from both the participant and plan sponsor perspective. We find these trends to be encouraging as we see increased participation rates and an increase in employer-sponsored retirement plans. At the end of the day, lower fees can translate to larger balances at retirement.

And while 3 basis points may seem like a drop in the bucket, it can have an impact on retirement plan balances over the long-term. For example, the difference of 0.03% results in an additional $1,206 on a starting account balance of $50,000 over a twenty-year period. As plan fees continue to decrease the savings could add up quickly.

So why has this trend continued? In our opinion, it’s heavily influenced by the overall increase in fee awareness within employer-sponsored retirement plans. This awareness can likely be attributed to the exponential rise of lawsuits surrounding high fees and the increased understanding of fiduciary responsibilities that are expected from plan sponsors and investment committee members. We have also seen overall fee compression caused by industry competition, especially in the mutual fund sector.

At Conrad Siegel, we have always communicated the importance of monitoring plan fees with our investment committee members. On an annual basis we review fees with each committee, benchmark fees against similarly sized plans, and review historical fees on a plan-by plan basis. In addition, we are always conscious of the impacts on fees when making any kind of investment change within a plan menu. As we like to say, we can’t control the market, but we can control costs.