Know Your Fiduciary Role!

Those who oversee qualified plans are either very familiar with the role they play for their employee retirement plan, or do not clearly understand the significance of their fiduciary duties. It is important to know your job within a qualified plan. Plan fiduciaries should understand the instrumental part they play and take the responsibilities afforded to them seriously.

The Employee Retirement Income Security Act of 1974 (ERISA) established a set of responsibilities for plan fiduciaries in order to protect individuals invested within the plan. The Federal law subjects plan fiduciaries to a set of minimum standards.

A Plan Fiduciary at a Glance

The primary goal of a fiduciary is to operate the plan for the sole interest of the plan participants and beneficiaries.

Duties and Tasks of a Fiduciary:

When do Fiduciary Duties Start for a Qualified Plan?

Fiduciary duties begin immediately following an employer’s decision to establish a qualified plan or after appointment to a fiduciary position. Fiduciary duties remain in effect until you properly remove yourself from the role.

A fiduciary’s duty is based on the function(s) a person executes for a plan, not just their title.

Am I a Fiduciary?

Every plan has at least ONE fiduciary: This may be a person, committee or entity.

A fiduciary’s responsibilities within the firm may cause him or her to have discretionary control over plan administration or plan assets. These functions themselves step over the line into a fiduciary role.

You’re not alone:

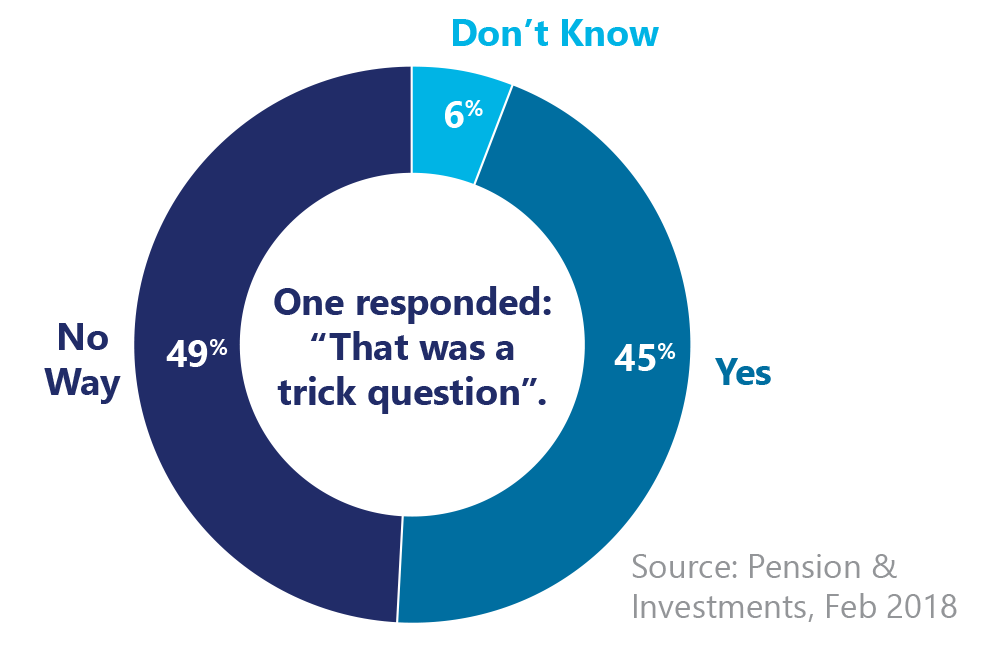

A survey was conducted by, AllianceBernstien LP. They asked more than 1,000 executives of Defined Contribution plans if they were a fiduciary:

49% said no and 6% said they didn’t know, but all were considered fiduciaries under ERISA.

Who are the most common plan fiduciaries?

NOTE: Accountants, actuaries, TPAs, and attorneys, are not commonly in a fiduciary role.

- Plan sponsors

- Plan trustees

- Investment advisors

- Plan’s administrative and Investment committee

Anyone who has:

- Discretion over appointing the plan committee

- Discretion over the plan

- Discretion over hiring and firing of plan providers.

Why is it important to know if you’re a Fiduciary?

A fiduciary may be held liable if they do not follow basic ERISA standards of conduct. It’s important to understand and know your fiduciary role within your employer’s qualified plan. If you are unsure if you’re a fiduciary, become familiar with your specific role within your organization and familiarize yourself with ERISA fiduciary duties. Your participants and their beneficiaries are depending on you to act prudently and in their best interest.

Get a better understanding of your retirement plan

Our 401(k) Grader provides a quick option for plan sponsors to benchmark their plan’s current investment process against industry best practices.

This article is to potentially help plan sponsors identify their role as a fiduciary for a qualified plan. This article is not comprehensive, nor tailored guidance to a specific qualified plan, and at no time should replace the expert advice of hired legal counsel. If you have specific questions regarding to the content within this article, we encourage to reach out to an expert or your ERISA counsel.