The Dreaded “R” Word

If you are following the markets in 2022, it is hard to avoid all the recession talk. In addition to general investor anxiety this year, there have been several events that also warrant a closer look at the recession topic. A few are:

- US Real Domestic Product decreased at an annualized rate of -1.5% in the first quarter of 2022 (www.bea.gov). Many define a recession as two consecutive quarters of negative GDP growth.

- The inversion of the two and ten-year treasury yields, a commonly referenced recession precursor, occurred on April 1st and 4th.(www.treasury.gov)

- The Fed has begun aggressively hiking interest rates in an attempt to rein in the highest inflation the US has experienced since the early 1980s. This also caused recession fears to rise. The higher interest rates get, the more restrictive monetary policy gets, which can slam the brakes on economic growth.

As an investor, none of these developments are encouraging. We thought it would be helpful to address some common high level questions that are being asked about the recession.

Is a recession coming?

Possibly in the next year or two, but definitely at some point in the long run. Unfortunately, we just don’t know when. Historically, recessions have been a normal part of the business cycle. The economy grows, certain sectors get too hot, and bubbles burst. We’ve seen it many times. There are numerous reasons for why this happens, and each recession is different. The US recently had its longest expansion on record, spanning 129 months from June 2009 to February 2020 (The National Bureau of Economic Research).

The recession that occurred with the onset of the Covid-19 pandemic was not a part of the normal business cycle since it was an “external” recession, meaning that it wasn’t caused by anything that had to do with financial markets. It was also the shortest on record, lasting only two months. This means that investors haven’t had to deal with a recession caused by financial markets since the Great Financial Crisis (“GFC”), and even this recession wasn’t the garden-variety type.

What we are trying to say here is that if you are a long-term investor, you will most likely have to endure possibly several recessions over the course of your investing lifetime.

What does a recession mean for the equity markets?

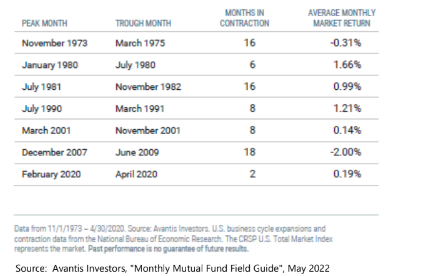

As you can imagine, an economic recession does not translate to an ideal environment to be a business owner or a stock investor. However, there are some important things to note when it comes to the relationship between the economy and the stock market. Weakness in the economy should mean weakness in stocks, right? Not exactly. Avantis, an ETF and mutual fund company associated with American Century recently published a study that found that the stock market (measured by the CRSP U.S. Total Stock Market Index) only fell during two of the past seven recessions.

The reason for this is that the stock market is forward looking, which means that it can be a leading indicator for where the economy is heading. A recent piece by Michael Cembalest of J.P. Morgan illustrated the movement between the stock market and US Gross Domestic Product. If we expand on the data presented in the chart from Avantis to include similar data, we can see that it is quite common for stock markets to fall in advance of a recession, and start a steep recovery before the recession ends.

What does a recession mean for the fixed income markets?

Economic Recessions are typically associated with falling interest rates as the Fed will cut rates to stimulate the economy and longer-term rates fall as a reflection of lower expected economic growth in the future. Falling rates leads to increasing prices and good bond returns. Of course, every recession is different and the US is currently experiencing inflation levels not seen since the recession in the early 1980s where the ten-year Treasury yield topped out above 15%. While we recognize that the losses to fixed income positions, year-to-date have been historic, the diversification provided by fixed income in times of a recession and the more attractive yields that are now available should encourage investors to not abandon holding bonds.

What changes should I make to my portfolio to prepare for a recession?

Experiencing a recession is part of the deal when it comes to being a long-term investor. Conrad Siegel believes that trying to time the market is very difficult to successfully accomplish once, and nearly impossible to do on an on-going basis. Instead, it is important to have the right asset allocation for your goals that allows you to stay invested in the markets, through the good times and the bad. When there are steep market sell- offs like the first half of 2022, it is an opportunity to rebalance and reset at the target asset allocation. Rebalancing is much easier to do when you are selling soaring equities, but to maximize the impact of rebalancing, investors need to be disciplined and “buy low” as well.

We know that it is a stressful time to be invested, and it seems that there is nothing but negative news circulating everywhere. We are by no means claiming the market has bottomed (no one knows), but history tells us that the markets will likely start a recovery before the economy bottoms. However, it’s important that you realize the reason why you are investing in the first place. Maybe it’s for retirement, a future purchase, or even for future generations. If your goal hasn’t changed, should your allocation? Most likely not, which is why we recommend staying the course and staying invested.