A first half like no other

If we would have told you in January that in the first half of 2020 there would be both a decline in the equity market that invoked comparisons of the Great Depression as well as a rally that was reminiscent of the tech boom of the late 90’s, all by the mid- way point of 2020, would you have laughed?

After years of steady growth in stocks, along with slow but steady growth in the economy and low inflation, investors came into 2020 expecting more of the same. Many financial analysts were calling for a more moderate return compared to 2019, but few were making bearish calls for the year…the pandemic changed that.

Initially, COVID-19 was just a concern within China. Then, hotspots emerged in Iran, Italy, and South Korea, followed by a worldwide outbreak. Eventually, a temporary global lock down was put in place to halt the movement of people and close businesses to try to “flatten the curve”.

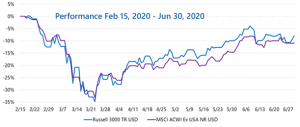

Within roughly one month, between February 15 and March 23, the Russell 3000 Index (a common gauge of U.S. equity performance) and the MSCI ACWI ex USA Index (a common gauge of equity market performance outside of the U.S.) fell by 34.8% and 33.2%, respectively. Then on March 23, the FED announced several programs to help ease investor worry and to shore up credit markets.

March 23rd marked a turning point in the equity markets with the Russell 3000 Index returning 41.2% from March 24 through June 30, 2020. Small domestic stocks (Russell 2000) and foreign stocks (MSCI ACWI ex USA) also had impressive rallies with returns of 44.4% and 33.5%, respectively. While all benchmarks are still negative by a material amount compared to their high point earlier in the year, the speed and size of the rally resulted in historical comparisons similar to the selloff in the 1st quarter of the year.

This rally had several contributing factors in our opinion: a historic selloff that set the stage for the rebound, aggressive actions by the FED, fiscal stimulus passed by Congress, and optimism surrounding the reopening of the global economy. However, the same turn around has not been experienced by the economy or the pandemic since March 23rd.

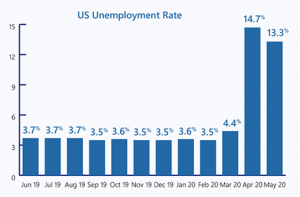

The restrictions put on businesses, especially those in the leisure, retail, and restaurant industries, really took a toll on not only these business’ bottom lines, but also on the employees who work there. The United States’ unemployment picture turned bleak very quickly in March and April as these employees were either laid off or let go. This caused a very sudden spike in the U.S. unemployment rate to 14.7% in April from 4.4% in March.

The pandemic also resulted in a broad decline in economic activity in the U.S. The National Bureau of Economic Research declared that the U.S. entered a recession in February of 2020, ending the longest economic expansion in U.S. history.

In the last two months, we have seen restrictions lifted in many states, along with many countries outside of the U.S. Unfortunately, this has coincided with increased infections amongst many states that have already opened, including the very populous states of Florida, Texas, and California. Daily cases have surged in the U.S. and were over 50,0002 for the first time on July 1st.

Whether or not this is the “second wave” that has been talked about is unknown, however, it does serve as a reminder that the pandemic is not over and that we will most likely need to keep some sort of restrictions in place over the longer term to fight its spread. This means that businesses will most likely not be able to go back to the normal way of doing things and will have to adapt.

Requiring masks and social distancing is easy to say, but hard to implement. Not only will this virus cause some people to just stay at home, but it will also require new procedures to be put into place, extensive cleaning, and new ways of delivering services and products to consumers. The true return to normal will not likely be achieved until a vaccine is widely available. The scientific community is making impressive progress in this effort, but the consensus appears to be that this won’t be accomplished until 2021.

Investors seem comfortable looking past the current economic and pandemic data and focusing instead on the subsequent recovery. The recovery from market lows in March has certainly looked like a “V” shaped recovery. However, the initial jump in returns has turned into a slow grind in recent weeks. Forecasts for the rest of the year are murkier than normal as no one can predict how the pandemic will evolve and to what extent temporary disruptions will turn into permanent damage to businesses. Short-term, investors’ focus will still be on the pandemic and how it will affect consumer spending and businesses reopening.

However, market participants also need to consider the long-term, which is what we recommend when it comes to investing for the future. There is no doubt that this Covid-19 pandemic has affected each and every one of U.S. in various ways, and it will most likely continue to do so, even after the spread has slowed to a manageable pace. We hope that you have stayed safe during these trying times.