Telemedicine: Managing Expectations of Savings

If you are involved in managing your organization’s healthcare benefit offering, you have almost certainly been approached by one – or many – different vendors about offering telemedicine benefits. Telemedicine is increasing in popularity and adoption, and like any growing area in employee benefits the market is becoming flooded with vendors and brokers trying to catch your attention with large savings. This is not going to be that type of article.

In this article, we are going to:

- Define telemedicine and why it is being offered by an increasing number of employers

- Compare two common service models for telemedicine services

- Discuss the question of whether or not telemedicine produces cost savings

- Advise caution when evaluating vendor savings estimates

- Provide recommendations for plan sponsors that are considering offering telemedicine (or items to consider for those that already offer telemedicine)

What is Telemedicine?

Telemedicine can have many definitions (and potentially many synonyms, depending on your source). For most employers, telemedicine can best be characterized as remote diagnosis or treatment of patients through use of technology (typically smartphones and specialized apps). Most health carriers now offer employers the option of offering telemedicine (or “virtual care”), and many employers have begun offering the benefit.

While every employer has different motivations, the most common reasons employers choose to offer telemedicine are:

- An expectation that telemedicine will save the employer money (more on this below).

- Due to competitive pressure to offer the benefit, as a result of other employers offering telemedicine and standard member communications from the health carrier promoting the benefit.

- To increase employee satisfaction by providing a convenient and less expensive alternative to traditional office and urgent care visits.

Telemedicine Service Models

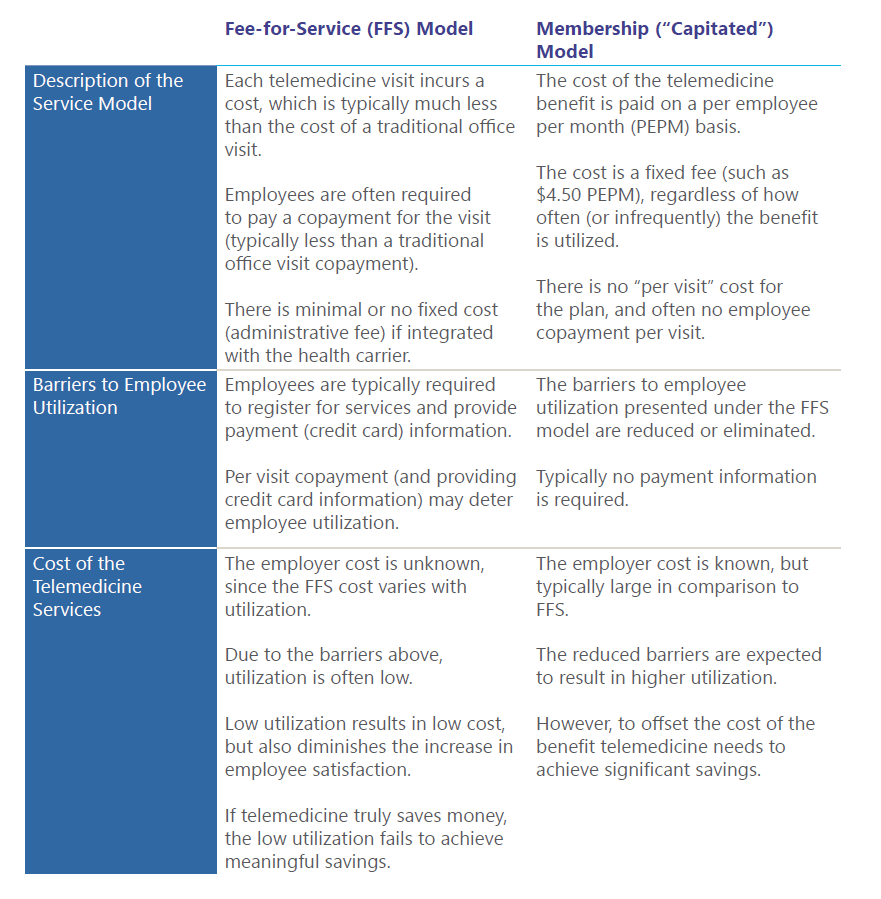

The telemedicine service model will vary by vendor. The chart below describes and compares the key components of the two most common service models:

Does Telemedicine Produce Savings?

Great question, and the answer will depend on the source. A vendor will tell you “YES!”, as will many brokers hoping to show value. Many traditional brick-and-mortar physicians will say no, believing telemedicine results in a lower quality of care that leads to more visits and higher costs. Studies of the impact of telemedicine have yielded mixed findings, some showing improved outcomes while others have found increased utilization with no demonstrable improvement in quality of care.

Basically, there is evidence to support both arguments. A review of the research is beyond the scope of this article, but the interested reader – which you most certainly are – can reference the Medicare Payment Advisory Commission (MedPAC) March 2018 report regarding telehealth services and the Medicare program.

Arguments for telemedicine

- Telemedicine is a lower cost service that will replace current utilization of more costly sites of care: primary care office visits, urgent care visits and emergency room visits.

- Basically, telemedicine saves money because it is less expensive than receiving care through traditional options.

Arguments against telemedicine

- That utilization will increase, since telemedicine is convenient and easily accessible. Telemedicine will supplement existing office visits, not replace them.

- That the quality of care is lower, resulting in worse outcomes.

In evaluating value, it is important to remember that vendors have a product to sell. We have seen a variety of vendor telemedicine savings estimates, with estimates ranging from $200 to $500 per visit! These estimates are based on assumptions that are very favorable to the vendor, and plan sponsors should exercise caution in relying on these assumed savings for budgeting purposes. This is particularly true of the membership model, where the larger fixed cost is often sold to the employer based on an inflated value of each telemedicine visit.

A common flaw in evaluating savings attributed to telemedicine is comparison to the “average” cost of service (this is particularly true of emergency room visits). Telemedicine cannot address all patient issues; complex and costly issues typically will still require traditional in-person care. As a result, the “average” cost of services is a poor choice for comparison, as the conditions that can be resolved through telemedicine will typically be at the lower end of the cost scale.

However, it is also important to note that telemedicine is still less expensive than traditional care at the low end of the cost scale. There is an opportunity for savings, but it is less than what a vendor would have you believe.

Recommendations for Plan Sponsors

While the cost savings that can be achieved through telemedicine are a matter for debate, there are non-financial elements that should be considered in assessing the value of telemedicine:

- A small, but growing, number of employees are starting to expect telemedicine services to be offered.

- Employees appreciate the low cost and convenient option presented by telemedicine.

In making a decision around telemedicine plan sponsors should:

- Understand your data. Knowing your baseline utilization of office visits, ER visits and urgent care visits can be beneficial in future years to gauge the impact of telemedicine on your plan (or lack thereof). Further, access to urgent care varies by region and the cost of urgent care varies depending on hospital affiliation – understanding the current cost of services can prove beneficial in considering the opportunity available through telemedicine.

- Evaluate the options. The integrated option through your health carrier may not be the best option for your population. Some employers may wish to consider membership models, hoping to achieve greater utilization and member satisfaction.

- View projected savings critically and budget conservatively. The value of telemedicine remains an area of debate. As such, plan sponsors should evaluate vendor savings estimates critically, and exercise caution in building telemedicine savings into their budgets.

- Increase awareness of the telemedicine benefit, if included in the benefit offering. Ultimately, the use of telemedicine is optional for employees. For some, this low cost, convenient alternative will be much appreciated.

In practice, we have generally advised our clients to include telemedicine services in their benefit offering. At Conrad Siegel, we do not believe there is a “one-size-fits-all” solution, and we do not sell products. We focus on evaluating the pros and cons of the different options in a context that is supported by data and consistent with the goals and objectives or our clients. In evaluating telemedicine, it is important to see beyond the vendor claims, set realistic expectations of financial outcomes, and focus on the additional value created through employee satisfaction and a more comprehensive and attractive benefits package.